Unknown Facts About Paul B Insurance Part D

Table of ContentsGet This Report on Paul B Insurance Part DPaul B Insurance Part D for DummiesThe Paul B Insurance Part D StatementsThe Buzz on Paul B Insurance Part DThe 10-Minute Rule for Paul B Insurance Part DGet This Report about Paul B Insurance Part D

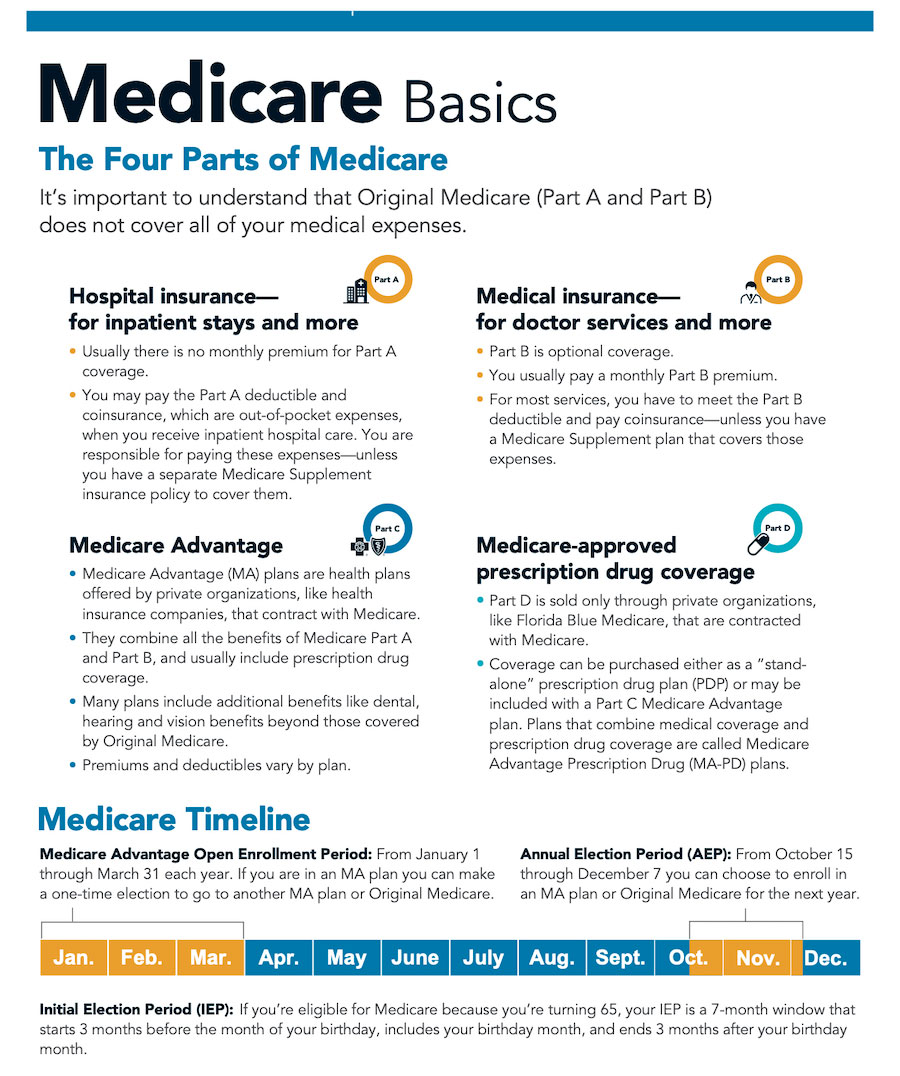

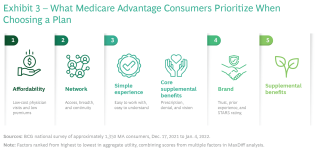

When the law was first passed, numerous individuals including the CBO predicted that Medicare Benefit registration would drop considerably over the coming years as payment reductions required plans to provide less advantages, higher out-of-pocket expenses, and narrower networks. That has not been the case at all. Medicare Advantage enrollment continues to grow each year.With Original Medicare, you still have deductibles and coinsurance. Medicare Benefit prepares normally do not have a medical deductible and have low, fixed copayments. Lots of Medicare Advantage strategies likewise consist of out-of-pocket limitations on what you will pay each year. Most of Medicare Benefit plans include protection for dental, vision, hearing, and prescription drugs. paul b insurance part d.

Rumored Buzz on Paul B Insurance Part D

There are 2 main ways to get Medicare coverage: Original Medicare, A Medicare Benefit Plan Original Medicare consists of Part A (hospital insurance coverage) and Part B (medical insurance). To help spend for things that aren't covered by Medicare, you can choose to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance).

Medigap policies differ and the most thorough coverage offered was through Strategy F, which covers all copays and deductibles. As of January 1, 2020, Plan F and Plan C, the 2 plans that covered deductibles can not be offered to brand-new Medicare beneficiaries. If you were qualified for Medicare prior to that time however haven't yet registered, you still may be able to get Strategy F or Plan C.

If you do not buy it when you first become qualified for itand are not covered by a drug plan through work or a spouseyou will be charged a life time charge if you shop it later. A Medicare Advantage Strategy is intended to be an all-in-one option to Original Medicare.

Rumored Buzz on Paul B Insurance Part D

Medicare Advantage Strategies do have an annual limit on your out-of-pocket costs for medical services, called the maximum out-of-pocket (MOOP). Once you reach this limitation, you'll pay nothing for covered services. Each strategy can have a different limitation, and the limitation can change each year, so that's an element to consider when purchasing one.

You may not be able to acquire a Medigap policy (if you change after the previously mentioned 12-month limitation). If you have the ability to do so, it may cost more than it would have when you first registered in Medicare. Remember that a company only requires to provide Medigap insurance coverage if you satisfy specific requirements concerning underwriting (if this is after the 12-month duration) (paul b insurance part d).

What Does Paul B Insurance Part D Do?

Most Medigap policies are issue-age ranked policies or attained-age ranked policies. This implies that click here for more info when you register later in life, you will pay more monthly than if you had actually started with the Medigap policy at age 65. You might have the ability to find a policy that has no age score, however those are unusual.

Also, make sure to discover if all your medical professionals accept the strategy which all the medications you take (if it's a strategy that likewise wraps in Part D prescription drug protection) will be covered. If the plan does not cover your current physicians, be sure that its medical professionals are acceptable to you and are taking brand-new clients covered by the strategy.

Prior to you enroll in a Medicare Benefit prepare it's important to know the following: Do all of your suppliers (doctors, medical facilities, etc) accept the plan? You need to have both Medicare Parts A and B and live in the service location for the strategy. You should remain in find this the strategy till the end of the fiscal year (there are a few exceptions to this).

Paul B Insurance Part D Things To Know Before You Get This

Medicare Advantage plans, also called Medicare Part C strategies, run as private health insurance within the Medicare program, working as coverage options to Original Medicare. In many cases, Medicare Advantage prepares offer more services at an expense that is the very same or cheaper than the Original Medicare program. What makes Medicare Advantage plans bad is they have more limitations than Initial Medicare on which doctors and medical facilities you can utilize.

Most of the expenses with Medicare Advantage plans come from copays, coinsurance, deductibles and other out-of-pocket expenses that emerge as part of the general care process. And these costs can rapidly escalate. If you need pricey healthcare, you could end up paying more out of pocket than you would with Original Medicare.

However after that deductible is fulfilled, there are no more expenses up until the 60th day of hospitalization. Most Medicare Advantage plans have their own policy deductible. But the plans start charging copays on the very first day of hospitalization. This suggests a recipient might spend more for a five-day healthcare facility stay under Medicare Advantage than Original Medicare.

Getting My Paul B Insurance Part D To Work

This This Site is specifically good for those who have ongoing medical conditions due to the fact that if you have Parts A and B alone, you won't have a cap on your medical costs. Going beyond the network is enabled under lots of Medicare Advantage chose service provider plans, though medical costs are greater than they are when staying within the strategy network.

Service providers must accept the terms and conditions of the strategy. Companies have the option of accepting or rejecting care with every see, creating possible interruptions in care. Emergency situation care is constantly covered.: These strategies supply advantages and services to beneficiaries with specific requirements or minimal incomes, tailoring their advantages to satisfy the needs of particular populations.